Our Services

Find the Right Finance for Your Next Big Move

We can help you with Home Loans to purchase a home to live in, SMSF lending, commercial finance and vehicle funding.

Whether you're buying your first home, investing in property, growing your business, or upgrading your equipment, we’re here to make finance as easy as possible. We have access to over 40 lenders and many years of experience to help you through every step of the application process

Homeloans:

First Home Buyer Loans and next home buyer loans

Investment Property Loans

Equity Release & Switching to other lenders with a lower Interest Rate

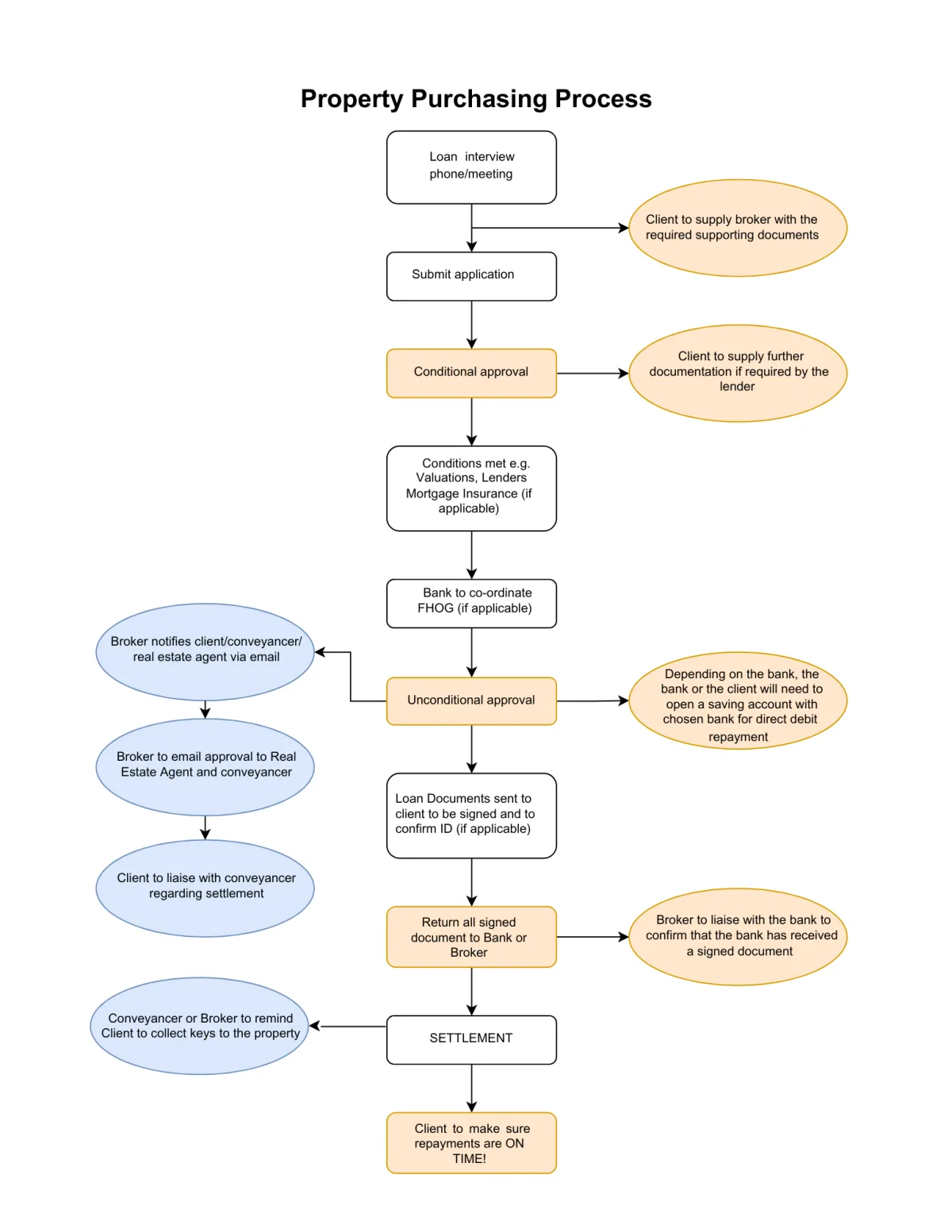

Property Purchasing Process

We have put together this chart below showing the various steps in the Home Loan process. This will give you an idea of what to expect.

We are here to make the process as simple as possible and will guide you through each stage in considering what lending strategy will work best for you.

By working with us we can help with:

The amount you need to borrow

The loan term that fits your financial situation

The level of flexibility you require in your loan

Working towards any future plans that may impact your loan choice

Expert financial advice and support

Most importantly, we will discuss and explain why the recommended lending option is the right fit for you.

Mortgage Loans: What You Need To Know

When it comes to choosing the right home loan, understanding the key features of different loan products is essential. Below we explain the most common loan types and options available.

Types of Mortgage Loan Products

Standard Variable Rate (SVR) Loan

A flexible loan where the interest rate can change over time, which will affect your minimum repayment amount. You can usually make extra repayments without penalty, but budgeting can be tricky due to the rate fluctuations.

Basic Variable Rate Loan

This is a simpler, cheaper version of the standard variable loan often having a lower interest rate. With some lenders a basic loan doesn’t offer extra features like offset accounts or redraw facilities but can be a good option if you don’t need the extras.

Fixed Rate Loan

Your interest rate is locked in for a set period (usually 1-5 years), so your repayments stay the same. Fixed payments make it easier to budget, but you may face restrictions on making extra repayments. After the fixed term ends, the rate will revert to a standard variable rate.

Line of Credit Loan

Works like a credit card, allowing you to borrow up to a set limit. You can access funds as needed and only pay interest on what you use. It’s flexible but usually comes with a higher interest rate than other loans.

Discount/Honeymoon Rate Loan

This loan offers a lower interest rate for an initial period (1-3 years). It’s a good option for lower repayments early on, but the rate increases after the honeymoon period ends.

Non-Conforming Loan

These loans are a good option for people who have had some credit issues in the past or for some reason don’t meet the credit requirements of traditional lenders. These loans usually have higher interest rates and stricter conditions but can be a solution if other lenders will not approve your application.

Loan Options

Loan Term

This is the length of time you agree to repay the loan. A standard term is 30 years, but shorter terms will result in higher monthly payments as you repay the loan more quickly.

Principal & Interest (P&I)

With this option, your repayments cover both the interest and the principal loan balance). Over the term of the loan the principal loan amount owing reduces to zero, this happens before your original loan term if you make extra repayments.

Interest Only (I.O.)

You only pay the interest on the loan for a set period (usually 1-5 years), with no reduction in the principal. This is often used by investors but repayments revert to principal and interest payments after this term with a higher repayment.

Interest in Advance

This option allows you to pay the next year’s interest upfront, which can offer tax benefits or save on interest costs, particularly for investors.

Lo Doc Loan

A loan option for self-employed people who don’t have the usual income documents (like tax returns). You declare your income, but you’ll need to provide more deposit or equity upfront.

Professional Package

This is a loan bundle for professionals, offering discounts on interest rates and access to some other benefits but has an annual fee. It’s ideal for those with higher loan balances who want flexibility and want the additional benefits.

Split Loan

A combination of both fixed and variable rates. You can enjoy the stability of fixed repayments and the flexibility of variable repayments, offering the best of both worlds.

Bridging Loan

If you're buying a new home before selling your current one, a bridging loan can help. It provides funds for your new property while you wait for your old home to sell.

Guarantee Loans

A third party, such as a parent, can guarantee part of the loan, which may help if you’re struggling to meet borrowing requirements. There are different types of guarantees, so it’s best to discuss this with a consultant.

Construction Loan

For those building a home, the lender provides progress payments to the builder throughout the construction at the various stages of the build. During this period, you typically make interest-only repayments, which convert to regular repayments after construction is complete.

Business & Commercial Loans

Types of Mortgage Loan Products

Business Loans

We can help & guide you the various options available which would suit you: either for a Brand New Business or an Experienced Business Owner who wants to expand their business location.

Commercial Loans

Commercial loans are loans provided to businesses to help clients fund operations, expand, or purchase assets such as property, equipment, or inventory. Commercial loans can be used for a variety of purposes, including working capital, purchasing equipment, or even refinancing existing debt.

Main Types of Commercial Loans

1.Term Loans

What it is: A lump sum of money provided upfront, which must be paid back in regular instalments (typically monthly) over a set period, usually 1 to 10 years.

Used for: Commonly used for major purchases, expansion, or debt refinancing.

Interest: Fixed or variable rates, depending on the loan terms.

2. Lines of Credit

What it is: A revolving credit facility, where the business can borrow funds as needed up to a certain limit and repay it over time. Similar to a credit card but with higher limits.

Interest: Interest is only charged on the amount used.

Used for: Ideal for covering short-term operating expenses or managing cash flow gaps.

3. Commercial Real Estate Loans

What it is: Loans specifically for purchasing, refinancing, or developing commercial real estate, like office buildings, retail centers, or industrial properties.

Used for: Common for businesses that own their premises or are looking to expand.

Interest: Typically fixed rates, with longer repayment terms (often 15-30 years).

4. Equipment Financing

What it is: Loans specifically designed to purchase or lease equipment for business use.

Used for: Businesses looking to buy machinery, vehicles, or technology for operations.

Interest: Can be structured similarly to a term loan.

5. Invoice Financing (Factoring)

What it is: Businesses sell their outstanding invoices to a lender at a discount in exchange for immediate cash.

Used for: Helps businesses with cash flow issues by converting accounts receivable into working capital.

Interest: Interest rates and fees are typically higher, as the lender assumes more risk.

6. Working Capital Loans

What it is: Loans used to cover day-to-day operational expenses, including payroll, inventory, and accounts payable.

Used for: Typically used to smooth over cash flow shortages rather than for long-term growth or investment.

Vehicle and Equipment Finance

Vehicle and equipment finance is a specialised form of financing that allows businesses to acquire vehicles or equipment needed for operations without paying the full price upfront. It can be an essential tool for businesses that need to manage cash flow while ensuring they have the necessary tools and transportation for their work.

SuperFund SMSF Loan

Unlock Your Super & Invest Smarter

If you have $200K or more in your super? You may be able to use it to invest in property. We can help you access it and turn it into a smart investment move.

What is an SMSF Loan?

A Self-Managed Super Fund (SMSF) loan lets you borrow through your super to invest in property. You can use it to:

- Buy a residential or commercial investment property

- Refinance an existing SMSF property loan

- Purchase offices, warehouses, or retail shops

Key Features

1. Loan Purpose

Usually used to buy real estate—residential or commercial. Other assets like shares may be eligible but are less common.

2. Eligible Assets

- Real estate: Residential or commercial

- Other assets: Shares or collectibles (if SMSF-compliant)

3. Borrowing Requirements

- Deposit of 20–30% usually required

- SMSF can borrow for one asset at a time

- Loan is secured only by the asset being purchased

4. Loan Terms

- Terms typically range from 15–30 years

- Interest rates are usually higher than standard home loans

5. Repayments

- Must be paid from SMSF income (e.g., rent, dividends)

- Must align with your SMSF’s investment strategy

6. Compliance Rules

- Must follow Superannuation Industry (Supervision) Act 1993

- Property can't be used personally or by SMSF members

7. Asset Protection

- Limited Recourse Borrowing Arrangement (LRBA) means only the purchased asset is at risk in case of default

How to Get an SMSF Loan

Step 1: Check Your Super Balance

You'll generally need at least $200,000 to make this strategy work.

7. Asset Protection

- Limited Recourse Borrowing Arrangement (LRBA) means only the purchased asset is at risk in case of default

Step 3: Choose a Suitable Investment

Find an eligible asset, typically real estate, that meets SMSF rules.

Step 4: Get Professional Advice

Consult with an SMSF specialist, financial adviser, or tax professional to stay compliant.

Step 5: Apply for the Loan

Work with a lender who offers SMSF loans. Provide details about your fund, finances, and investment.

Step 6: Loan Approval & Setup

Once approved, the loan is set up under an LRBA. Terms and repayments are confirmed.

Step 7: Buy the Property

The asset is bought in the name of a holding trust. Your SMSF owns it outright once the loan is repaid.

Step 8: Maintain Compliance

Ensure ongoing compliance with super laws and make repayments as per your SMSF’s strategy.

Advantages of SMSF Loans

1. Control Over Investments:

SMSFs provide greater control over the investment portfolio. You can choose exactly where you want to invest, including selecting specific properties or assets.

2. Tax Benefits:

Investment earnings within an SMSF are generally taxed at a lower rate (15%) compared to personal income tax rates, and the capital gains tax rate may be reduced to 10% or 0% if the asset is held for more than 12 months and is sold after the fund reaches pension phase.

3. Diversification:

SMSF loans allow you to diversify your retirement portfolio by adding assets such as real estate, which can provide long-term growth and income.

4. Asset Protection:

SMSFs offer asset protection, meaning that the assets in the SMSF are generally protected from creditors if the SMSF trustee is not in default.

5. Potential for High Returns:

Real estate, in particular, has historically been a strong performer in terms of investment returns, and using an SMSF to finance a property purchase can boost the value of your retirement savings.

Contact Us Today

Tell us a bit about your plans, and we’ll help you find the best loan to match. We compare options across many lenders to secure the best fit for you.

Licence Agreement: Simply Finance Pty Ltd is a Corporate Credit Representative of Australian Associated Advisers Pty Ltd. Corporate Credit Presentative Number: 494218. Australian Associated Advisers Pty Ltd Australian Credit Licence: 392169 ACN: 084 974 694

We act in your best interest and comply with the NCCP Act.