10+ Years Experience. 40+ Lenders Across Australia.

Save Thousands on Interest and Fees. Secure the Right Loan For Your Life, Fast & Easy.

Trusted by over 1,200 families throughout Australia and counting.

Welcome to Simply Finance

Why Choose a Mortgage Broker Instead of a Bank?

When you're buying a home, refinancing, or investing, you've got choices. We will research and show you comparisons and options so that you can make a decision that works best for you comparing various lender products not just products available with one Bank.

Why Choose Simply Finance?

Why Our Clients Choose Simply Finance

Better Options

Clear Guidance

Fast Approvals

1. More Lenders Means Better Options

Banks are limited to their own products. We’re not. We compare loans from over 40 lenders to find the one that best fits your circumstance and requirements, not the other way around. That means great rates, more options and smarter loan structures.

2. Guidance You Can Actually Understand

We want to help you, we don’t expect you to be a finance expert. Our job is to explain everything clearly, answer your questions honestly, and make sure you feel confident every step of the way.

3. Responsible Lending & Best Interest Duty

We ensure to act in your best interest and comply with the NCCP Act.

4. We Handle the Heavy Lifting

Shopping for a Home Loan can be confusing. We do that work for you. We compare lenders, manage the paperwork, and deal with the Lender credit assessment team so you don’t have to. We have the experience to push for better rates and terms that suit your goals.

5. Faster Approval

We have good relationships with lenders and understanding of how they work, so we do our best to get your application processed as quickly as possible and avoid unnecessary delays. That means less waiting and a better chance of securing the property you want.

6. Support That Doesn’t Stop at Settlement

Once your loan’s approved, we don’t disappear. We want to keep in touch, so whether you’re thinking about refinancing down the track or just need some advice, we’re always here to help.

The Founder

Chi Pham: Founder – Finance Broker

Led by experienced Finance Broker Chi Pham, we offer access to a broad panel of lenders, personalised support, and smart solutions to suit your unique goals. With over a decade of experience you will be in expert hands.

With over 10 years of experience as a Finance Broker, Chi is a trusted expert who thrives on delivering results. Fluent in both English and Vietnamese, she connects with clients from all walks of life, providing solutions that fit their unique needs.

Chi has helped many of her valued customers with property loans, car financing, and refinancing. As well as securing the right loan, she works with her clients so that they have the knowledge to make confident, long-term financial decisions.

Loans We Specialise In

Whether you're buying a home, growing your business, or investing through super, we’ve got you covered.

Mortgage Loans

Business & Commercial Loans

Vehicle and Equipment Finance

SuperFund SMSF Loans

And more

OUR PANEL OF OVER 60 LENDERS

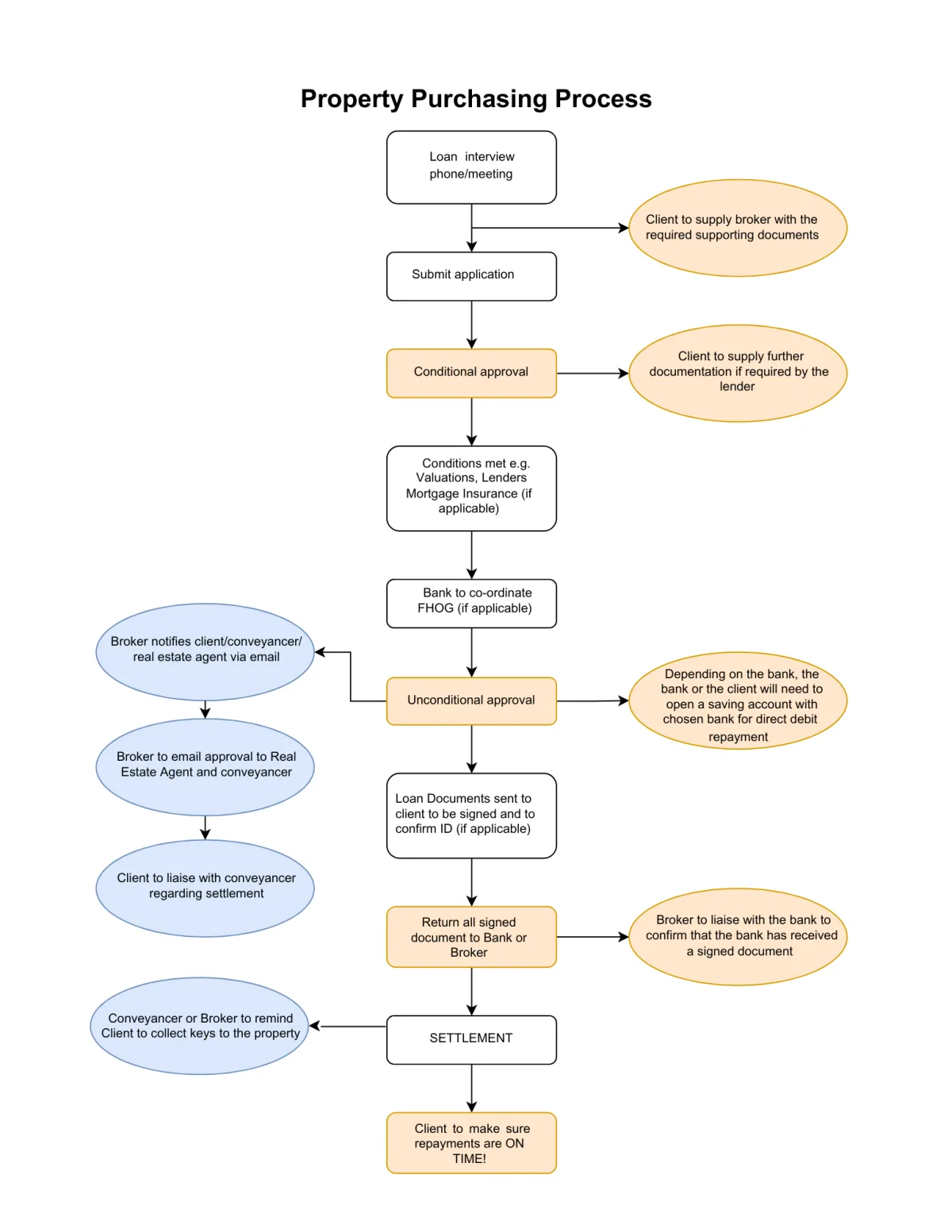

Property Purchasing Process

So you know what to expect when getting a home loan, we have put together a visual diagram of the process. To view all our services, check out our Services page.

Contact Us Today

Tell us a bit about your plans, and we’ll help you find the best loan to match. We compare options across many lenders to secure the best fit for you.

Testimonials

— Stephen H.

Working with Chi to secure my home loan and investment loan was an exceptional experience. She made the entire process simple, stress-free, and kept me updated every step of the way. Chi’s knowledge of the market and attention to detail gave me complete confidence, and she was always available to answer my questions. I highly recommend Chi to anyone looking for a professional and genuinely caring mortgage broker.

— H & T Nguyen.

Chi helped me and my wife refinance our current home and buy another investment property. It took us about 6 weeks to receive full approval from the bank since we first met Chi at her office. The experience was excellent. She is very knowledgeable and patient, which made the entire mortgage process smooth and stress-free. As self-employed business owners with a complex structure, we’d struggled to find a broker who could get things over the line—until we found Chi Simply Finance. She was truly understood our situation and worked tirelessly to get our mortgage sorted. She took the time to explain everything clearly and professionally. She kept me informed through every step and was always available to answer my questions. I would highly recommend Chi to anyone looking for a mortgage broker.

— Binh

I can’t thank Chi enough for her help in securing my home loan at short notice. She even assisted me over the weekend to make sure everything went smoothly. Thanks to her dedication and guidance, I was able to purchase my house quickly and with confidence. Chi made the process easy and stress-free, and I highly recommend her to anyone looking for a mortgage broker who goes the extra mile.

— H Nguyen and G Dinh

I am pleased to share my exceptional experience with the Simply Finance team, particularly Chi Pham. Throughout the mortgage process, Chi demonstrated remarkable professionalism and attentiveness, ensuring a seamless and stress-free journey toward securing my dream home.

In addition to their mortgage expertise, the team provided invaluable guidance on SMSF services and investment property strategies. Their commitment to understanding my financial objectives and delivering tailored advice instilled confidence at every stage.

Thanks to their support, I now have a solid foundation for both my personal and investment property portfolio. I extend my sincere gratitude to Chi and the entire Simply Finance team for their outstanding service. I highly recommend them to anyone seeking reliable, knowledgeable, and genuinely supportive financial assistance.

Frequently Asked Questions

Why Use a Mortgage Broker?

We simplify the process of obtaining a home loan by researching the various mortgage options available to find competitive rates and acting in the borrower’s best interest to find the loan that suits your needs and requirements and explaining the differences between options. We work with the selected lender and handle all the necessary steps with you from original consultation to post loan settlement keeping in touch with you throughout the process.

Who is on our panel of lenders?

We have access to 60+ Lenders and can offer detailed comparisons between lenders on interest rates and specific loan features.

What documents will I need to provide when I apply for a Home Loan?

- Proof of your identity (passport, driver's licence, birth certificate, utility bill or rates notice)

- Evidence of income (most recent payslips and income statement) or if self-employed 2 years Financials and Tax returns

- Details of outstanding debts, like credit cards, personal loans, student loans, including how much you owe and your repayment amounts

- If purchasing a home proof that you can pay the deposit and evidence of savings history by providing bank statements or gift declaration

- Statement of assets (including superannuation, savings and other assets)

- Evidence of your monthly expenses, including school fees, rent, dining out and regular bills like utilities by providing statements of your everyday transaction accounts.

- Proof of employment (address and contact details of employer and length of employment)

- Residential status (Council rates notice)

- Visa Status

What are the fees on the loan?

Loan Fees can vary from loan to loan; however we will provide detailed information specific to the product you select for your loan. There can be a number of fees associated with a mortgage including ongoing monthly fees, package fees, rate lock fees application fees, as well as valuation and settlement fees.

How We Get Paid

We get paid by the lender once the loan is settled after 6 weeks. Upfront commission payable by lenders in relation to loans is calculated as a percentage of the loan amount and is generally in the range of 0.40% and 1% of the loan amount. It is usually paid after settlement of the loan.

Trail commission payable by lenders in relation to loans is generally calculated regularly (monthly, quarterly, bi-monthly or annually) on the outstanding balance and is paid in arrears. The trail commission payable by lenders is generally in the range of 0.15% per annum and 0.55% per annum of the outstanding loan amount.

Can I lock in my mortgage interest rate for a fixed rate loan?

Rate lock allows you to lock in the current fixed interest rate offered by your lender for a specific period It protects you from potential interest rate increases between the time you apply for the loan and when it settles. The lender will charge a non-refundable rate lock fee.

Is there a fee to make additional repayments?

Whether there are fees for making additional repayments on a loan depends on the type of loan and the lender. Fixed-rate loans often have limitations on the amount of extra repayments allowed within a specific period (e.g., $10,000 per year) while variable-rate loans often allow unlimited additional repayments without fees.

How much can I borrow and what is the maximum purchase price?

Your borrowing capacity and maximum purchase price available to you is determined by several factors

- Income and employment type

- Living expenses and financial commitments

- Existing debts (e.g. credit cards, car loans, personal loans)

- Credit score and history

- The specific lender’s policy, including how they assess serviceability

Which payment frequency works best for me?

Paying off your loan fortnightly or weekly can save you in interest and cut your loan term down by several years. Synchronising your mortgage repayment frequency with how often you get paid can also be a great way to help you budget.

What happens if my financial situation changes?

If your circumstances have changed, and you think you’ll find it difficult to meet your required repayments it is best to contact your lender straight away. All lenders have hardship teams ready to help customers in tough times. Talk to your lender to discuss your options. You may be able to change the terms of your loan or temporarily pause or reduce your repayments based on your changed circumstances.

Should I choose a fixed or variable interest rate for my mortgage?

Deciding on a home loan that comes with a fixed or variable rate of interest will depend upon your personal and financial circumstances.

Fixed rate loans offer stability in repayments for a set term (typically 1 to 5 years) they work well for budgeting or if you are concerned that interest rates could rise soon. Interest rates on variable rate loans may rise or fall based on market conditions. They offer more flexibility with redraw options and usually unlimited extra repayments. You have the option to choose a split loan with a mix of fixed and variable features.

What is the comparison rate?

The comparison rate is the rate that helps you work out the true cost of a loan. It helps you assess the interest rate plus most fees and charges relating to the loan. Using this to compare different lenders and different loans is important and gives you a much clearer view of which option is the best for you.

What is Lenders Mortgage Insurance (LMI)?

Lenders Mortgage Insurance (LMI) is a premium paid by borrowers at settlement of their loan who have a deposit smaller than 20% of the property’s value. It can be added to the loan amount. It protects the lender, not the borrower in the event of loan default. It enables borrowers to get into the market sooner with a lower deposit. Some lenders offer a waiver on this fee for Doctors, nurses, lawyers, accountants, police officers, ambulance officers and some other professionals

Can I pay out this home loan in 2 years?

It is possible to pay off a home loan earlier than the original term. The time this takes depends mostly on your financial situation. Factors like whether you have a fixed or variable interest rate and your ability to make additional payments all play a role.

If you have a fixed rate there are generally penalties for early repayment.

Things to consider to pay off your loan faster.

Increase Regular Repayments: Even small increases can make a big difference over time.

Make Lump Sum Payments: When you have extra funds, consider making lump sum repayments to reduce the principal balance.

Use Offset Accounts: If your loan has an offset account, depositing savings into it can reduce the interest you pay.

Consider Refinancing: If you can find a lower interest rate, refinancing your loan could help you pay it off faster.

Can I still apply for a home loan/investment loan if I have a paid default or unpaid default ?

Yes, it's possible to get a home loan or investment loan even with a default on your credit file. Whilst it can restrict lender options because major banks are stricter, we have access to specialist lenders who are more flexible and may approve loans with defaults. Things like the details of the default and your current overall financial situation will be taken into consideration.

My spouse and I are self employed with an ABN that has been registered for only 1 year. Can we still apply for a home loan?

Yes, you can apply for a home loan, even with an ABN registered for only one year. Lenders typically prefer a longer period of self-employment to assess income stability and repayment capacity, however, we have access to some lenders that may consider applications with only one year of ABN registration, especially if you have other supporting documentation like a strong credit history, tax returns, and business activity statement as evidence of your current financial position. If you have limited financial documentation, we may need to explore options of low-doc home loans, which may have higher interest rates or different terms.

What is a redraw facility?

A redraw facility allows you to make extra repayments on your home loan, reducing your interest payments and potentially paying off the loan faster. You can then access these pre-paid funds by "redrawing" them. This feature is typically available only on variable rate home loans.

What is an offset account?

An offset account is a linked transaction account that can reduce the interest paid on a home loan. You can deposit wages or savings into this account and instead of paying interest on the full loan balance, interest is calculated on the difference between the loan balance and the offset account balance.

What is the difference between a pre-approval and full approval?

A pre-approval is provided after the lender's initial assessment of your borrowing capacity, indicating how much they might lend you based on the information provided; however it is not a guarantee that they will definitely lend you this amount and is subject to certain conditions. A full approval, also known as unconditional or formal approval, is the lender's final decision to approve your loan for a specific property purchase or refinance amount after a thorough assessment of your situation.

What is a building inspection and when can we arrange it?

A building inspection is a thorough assessment of a property's condition, conducted by a qualified building inspector, to identify and provide a proposed purchaser details of any damage, deterioration, defects, or noncompliance with building standards. A detailed report is provided including photos and recommendations for repairs or anything requiring further investigation. Prices vary for this service.

It's generally arranged during the negotiation period or 'cooling-off' period when buying a property but can also be done during the construction phase or for existing buildings with concerns.

How does the First Home Guarantee work?

The First Home Guarantee (FGHBG) is a government scheme that allows eligible first home buyers to purchase or build a new home with a deposit of as little as 5%, without needing to pay Lenders' Mortgage Insurance (LMI). It is an initiative to help first home buyers purchase their first home sooner. There are eligibility criteria to meet the requirements for this scheme which is only available with certain participating lenders.

We can discuss in more detail with you, however home buyers must be:

- Applying as an individual or two joint applicants

- An Australian citizen(s) or permanent resident(s) at the time they enter the loan

- At least 18 years of age

- Earning up to $125,000 for individuals or $200,000 for joint applicants, as shown on the Notice of Assessment (issued by the Australian Taxation Office)

- Intending to be owner-occupiers of the purchased property

- First home buyers or previous homeowners who haven't owned or had an interest in a real property in Australia (this includes owning land only) in the past ten years.

We heard about a shared equity loan to increase our budget. How does it work?

With the Homestart Finance Shared Equity Option, they can lend you between 5% and 25% of the property value or purchase price, whichever is lower. You become the owner of the home, but you share some of its value with HomeStart.

This shared equity option can increase your borrowing capacity without adding to your monthly repayments. You can choose to make voluntary repayments of $10,000 or more at any time, this would reduce HomeStart’s share in the value of your property.

You’ll repay this loan when you:

- sell your property, or

- refinance with another lender, or

- voluntarily pay out the Shared Equity Option.

- Lender doesn’t charge interest on the shared equity part of your loan. Instead, when you sell your property, they share in any gain or loss in property value.

- For example, if they lend you 20% of the purchase price with this loan, their share in the value of your property will be 20%.

Licence Agreement: Simply Finance Pty Ltd is a Corporate Credit Representative of Australian Associated Advisers Pty Ltd. Corporate Credit Presentative Number: 494218. Australian Associated Advisers Pty Ltd Australian Credit Licence: 392169 ACN: 084 974 694

We act in your best interest and comply with the NCCP Act.